For one thing, as touched on above, it is compulsory for a lot of sectors and countries. However, beyond that businesses should embrace carbon accounting to remain competitive and responsible in an evolving market.

With increasing regulatory pressures, investor expectations, and consumer demand for sustainable practices, tracking carbon emissions is a key revenue-generating strategy even when it is optional.

Carbon accounting helps businesses comply with regulations, manage risk, and enhance their market position by demonstrating environmental responsibility which leads to positive embracing throughout different demographics. In doing so, they build resilience against climate-related disruptions and future-proof their operations.

Reduce Carbon Footprint

Accurate carbon accounting is key for any company to reduce their carbon footprint (total greenhouse gas emissions). By quantifying emissions, companies can set tangible goals for reduction and identify key areas to improve. Whether it’s transitioning to electric vehicles for transportation, upgrading to energy-efficient equipment, or sourcing materials sustainably, carbon accounting offers actionable insights into where the biggest gains can be made. Over time, this leads to reduced environmental impact and better alignment with global sustainability goals. The best part of it is that not only is it better for the environment it has a hugely positive impact on a company’s bottom line.

Cost Savings

One of the primary benefits of carbon accounting is cost savings. By tracking energy usage, fuel consumption, and other carbon-intensive activities, companies can identify inefficiencies and areas where emissions—and costs—can be reduced. Simple steps like optimising energy use in operations, switching to renewable energy, or improving logistics efficiency can lead to significant savings. Over time, minimising waste and unnecessary energy consumption reduces operational expenses, making the business leaner and more profitable.

Alongside this, showing a sustainable approach to business not only increases the calibre of recruitment and longevity of how long people choose to stay at the organisation but brands that have a positive green impact are a huge buying consideration for many consumers showing it has a direct impact on revenue.

Implement Mitigation Strategies

Carbon accounting provides the data needed to implement effective mitigation strategies. Once businesses understand their emissions profile, they can prioritise actions to reduce their carbon footprint. Whether switching to greener energy sources, investing in energy-efficient technologies, or restructuring supply chains to reduce Scope 3 emissions, carbon accounting helps businesses take targeted actions. This type of approach allows a company to be proactive, reducing potential challenges further down the line and allowing them to get in front of their highest emission sources. In this day and age, ignorance is not the defence it once was and it is important for companies to be aware.

Monitor and Review Progress

A crucial function of carbon accounting is the ability to monitor and review progress over time. Carbon Accounting is the cornerstone of this because only when you fully understand how emissions work and where you are at as an organisation can you then begin to implement emission reduction strategies, carbon accounting tools help them track improvements and adjust their approach as necessary. Regular monitoring ensures that companies stay on course to meet their sustainability goals and adjust quickly if strategies are not yielding the expected results. This process also supports better decision-making, as businesses can continually optimise their efforts based on real-time data rather than guesswork which is where misinformation can sneak into the public discourse.

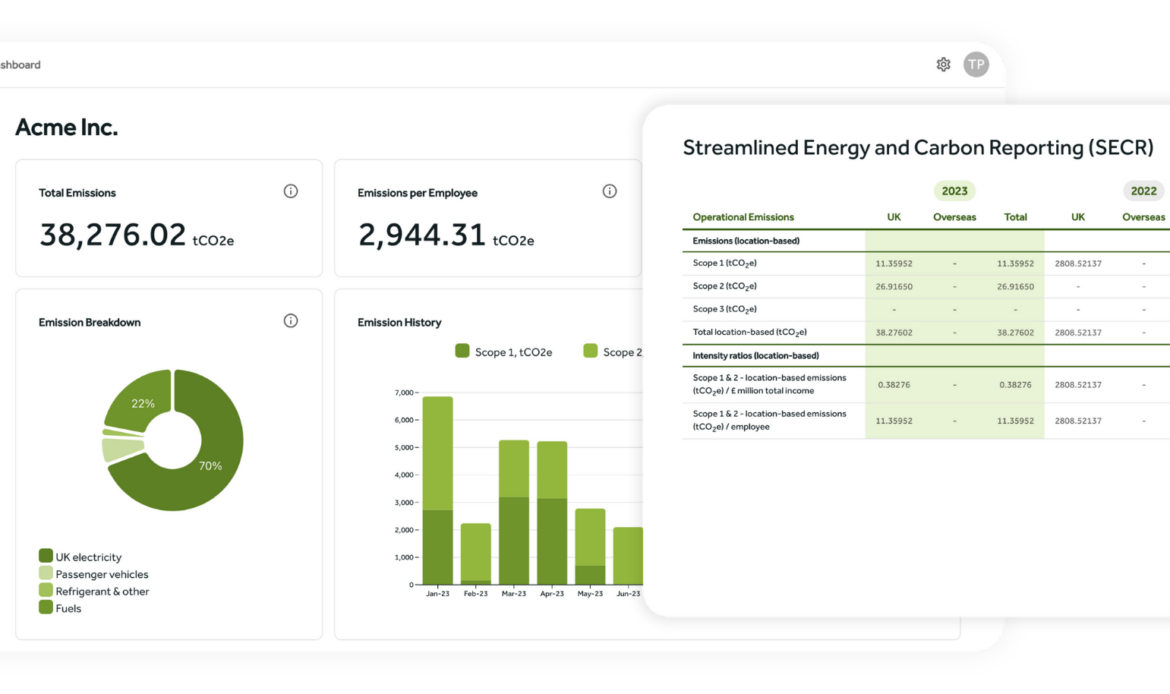

Regulatory Compliance

As governments worldwide impose stricter regulations on reducing carbon emissions, businesses must ensure regulatory compliance. Carbon accounting helps organisations stay ahead of the curve by providing the necessary data to meet reporting obligations, such as those outlined in the European Union’s Emissions Trading Scheme (ETS) or the UK’s Streamlined Energy and Carbon Reporting (SECR). Carbon Accounting is the best way to stay on the right side of this. Not least because, by maintaining accurate and transparent emissions data, companies can avoid penalties and fines, and also avoid any reputational damage associated with non-compliance which can have an extremely negative impact on sales and revenue.

Risk Management

Effective risk management is another critical benefit of carbon accounting. Climate change poses risks to business operations, supply chains, and financial performance. By understanding their emissions and environmental impact, companies can better anticipate regulatory changes, carbon pricing mechanisms, and the physical risks of climate change, such as extreme weather events. Carbon accounting is one of those rare options where not only will it be a revenue driver for the business, but it actively helps the world in the face of environmental challenges. Definition of a win-win!

Competitive Advantages

Businesses that adopt carbon accounting early steal a march on their various competitors. Not only, as mentioned above, do consumers significantly prefer brands that are transparent and proactive in this regard, but it also makes a huge difference to morale internally. As consumers increasingly prefer sustainable brands and governments introduce more stringent regulations, companies that can demonstrate a low-carbon footprint or significant progress toward reducing emissions will stand out. These businesses are better positioned to win contracts, gain customer loyalty, and attract environmentally conscious investors, giving them a clear edge over competitors lagging in sustainability efforts.

Stakeholder Expectations

Stakeholders come in many forms these days. Whether investors, customers, and employees, have rising expectations for corporate responsibility and will price assets accordingly. Carbon accounting allows companies to meet stakeholder expectations for environmental transparency. Investors are increasingly looking for ESG (Environmental, Social, and Governance) performance as a measure of a company’s long-term viability, while consumers prefer brands that prioritise sustainability. Employees, too, want to work for companies that reflect their values. Transparent carbon accounting helps businesses build trust and credibility with all stakeholders.

Brand Reputation

A company’s brand reputation is increasingly tied to its environmental impact. Businesses that can demonstrate a strong commitment to reducing emissions through carbon accounting build a reputation for responsibility and leadership in sustainability. It is important to be proactive and publish with easy to find documentation as consumer attitudes to organisations these days are very much of the ‘guilty until proven innocent’ mindset. Companies that ignore carbon management risk damaging their brand, facing backlash from consumers, investors, and the media. By adopting carbon accounting practices, businesses not only reduce their environmental footprint but also strengthen their market position and public image.

Investment Attraction

Carbon accounting plays a critical role in attracting investment. As more investors incorporate ESG criteria into their decision-making processes, companies that can showcase measurable sustainability efforts are more likely to secure funding. In fact, it is likely that brands with no carbon accounting whatsoever will likely be rejected straight out. Carbon accounting provides the verifiable data that investors need to assess a company’s environmental performance and its long-term viability in a low-carbon economy. Businesses that actively reduce their carbon footprint are seen as lower risk and more attractive to capital providers.

Innovation Encouragement

Adopting carbon accounting encourages innovation within organisations. By identifying inefficiencies and areas for improvement, companies are driven to develop new technologies, products, or processes that reduce emissions. Whether it’s through innovative supply chain management, developing carbon-neutral products, or adopting cutting-edge energy technologies, carbon accounting can spark creativity and forward-thinking solutions that enhance both sustainability and competitiveness.

Long-Term Sustainability

Finally, carbon accounting is vital for ensuring long-term sustainability for all of us. By monitoring and managing emissions, businesses can make informed decisions that align with future environmental trends and reduce their exposure to climate-related risks. Over time, these efforts help businesses build more resilient operations, foster innovation, and meet global sustainability goals. In doing so, they contribute to a more sustainable future while securing their place in an increasingly green economy.